How payment facilitators can help businesses get more revenue

Technology

In today’s fast-paced world, businesses of all sizes are constantly seeking ways to increase their revenue streams. One strategy that has gained significant traction in recent years is leveraging the services of payment facilitators. Payment facilitators, also known as payfacs, have transformed the way businesses process payments, making it easier, faster, and more efficient.

But how can payment facilitators help businesses get more revenue? In this blog post, we’ll explore what payment facilitators are, as well as the ways in which they can improve a business’s bottom line.

What is a payment facilitator?

A payfac is a financial services entity that acts as a bridge between businesses and payment processors. Their primary role is to simplify and speed up accepting payments for businesses, particularly small- and medium-sized enterprises.

Payment facilitators simplify onboarding and transaction handling, reducing traditional payment processing complexity. By acting as an intermediary, they make navigating the realm of electronic payments more accessible, ultimately enhancing the overall payment experience for businesses and their customers.

How can a payfac increase the bottom line?

Payment facilitators can offer several benefits directly impacting a company’s bottom line. These include:

- Streamlined onboarding and payment processing

One of the key advantages payfacs bring to the table is their ability to streamline the onboarding process. Traditional payment processors often require a lengthy, complex application and underwriting process that can take months to complete.

This not only delays revenue generation but can also deter potential clients. Payment facilitators, on the other hand, offer a simplified onboarding process that can be completed in a matter of days or even hours in some cases. This means businesses can start accepting payments faster, which leads to an immediate revenue boost.

- Enhanced payment options

Payment facilitators offer a wide range of payment options that can help attract more customers. With the increasing popularity of online and mobile payments, it’s crucial for businesses to provide various payment methods to cater to the diverse preferences of their customers.

This has tangible real-world consequences. A merchant that only accepts cash, for instance, will lose out on business from consumers that wish to pay using their debit/credit card. Payment facilitators often support not only credit and debit card payments but also e-wallets, ACH transfers, and more. By offering these options, businesses can capture a larger market share.

- Reduced cart abandonment rates

Cart abandonment is perhaps the number one challenge for e-commerce businesses. According to various studies, more than 70% of online shoppers abandon their carts during the checkout process. Payment facilitators can help mitigate this issue by offering a seamless and user-friendly payment experience.

However, with the help of features such as one-click checkout and saved payment information, the process becomes more convenient for customers. This can increase the conversion rate, ultimately leading to higher revenue.

- Better data security and fraud protection

Data breaches and online fraud pose a severe threat to businesses. Payment facilitators are equipped with advanced security measures and fraud detection tools that protect both the business and its customers – especially if they are certified PCI DSS Level 1.

Customers are more likely to trust businesses that prioritize their security, and this trust can result in increased revenue. Furthermore, by preventing fraud and chargebacks, payment facilitators can save businesses substantial amounts of money that would otherwise be lost to fraudulent transactions.

- Access to valuable analytics

Understanding customer behavior and transaction patterns can be a great way to foster business growth. Payment facilitators typically provide robust analytics and reporting tools that offer insights into sales trends, customer preferences, and other key performance indicators.

Armed with this data, businesses can make informed decisions to optimize their revenue strategies. For example, they can tailor their marketing efforts to target specific customer segments or optimize pricing and product offerings.

- Global expansion opportunities

For organizations looking to expand into international markets, payment facilitators can be invaluable. They often support a wide range of currencies and have the infrastructure to handle international money transfers. This means that businesses can reach a global audience and tap into new revenue streams. Expanding internationally can be a great revenue booster, and payment facilitators simplify the process.

Conclusion

In conclusion, payment facilitators have the potential to significantly increase a business’ revenue. By simplifying onboarding, offering diverse payments, and improving security, payment facilitators address key pain points that can limit a business’s growth potential.

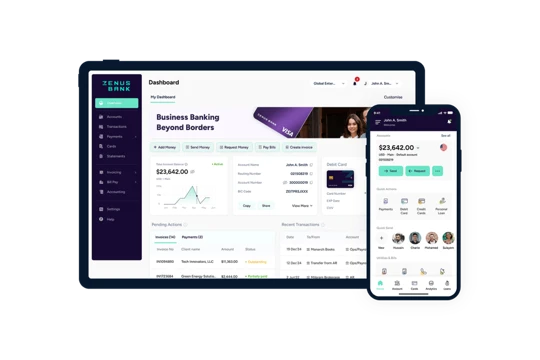

Zenus mission is to take banking beyond borders. Zenus offers cutting-edge payment facilitation solutions services that make it easy for businesses to gain a competitive advantage in today’s competitive landscape. If you’re considering the services of a payfac, we’d be happy to discuss how we can help you achieve higher revenue and sustained success.