Choosing the right BIN sponsorship partner

Technology

In today’s busy marketplace, businesses are always looking for new ways to make their brand more visible, engage with the community, and increase profits. One innovative approach for many organizations is to offer financial services such as branded cards that come with unique benefits and perks. Choosing the right partner for BIN sponsorship, therefore, is crucial for any business entering the realm of payment processing.

Today, we delve into what BIN sponsorship is and the key factors to contemplate when choosing a BIN sponsor. Additionally, we introduce Zenus Bank’s BIN sponsorship offering and illustrate how businesses can benefit from partnering with us.

What is a BIN?

First, let’s take care of the basics. BIN stands for Bank Identification Number, and it is the initial set of four to six numbers on a payment card that uniquely identify the institution that issued the card. These numbers are crucial for routing transactions correctly and verifying the authenticity of the card. The BIN helps merchants and financial institutions prevent fraud by identifying the card issuer and matching it against transaction data.

What is BIN sponsorship?

Now that we have clarified what a BIN is, let’s focus on the sponsorship part. BIN sponsorship refers to the arrangement where a financial institution, such as a bank, sponsors a BIN on behalf of another organization, typically a company or a payment service provider. BIN sponsorship allows organizations without their own banking license to issue payment cards or process card transactions under the sponsor bank’s license and BIN. This arrangement enables companies to offer branded payment cards or payment processing services without needing to obtain their own banking license, which is a complex and costly process.

How can BIN sponsorship help organizations?

One of the primary benefits of BIN sponsorship lies in its ability to provide organizations with streamlined access to payment infrastructure. Rather than investing significant resources and time into developing proprietary payment systems, businesses can leverage the existing infrastructure and expertise of their BIN sponsor. This access accelerates the deployment of payment solutions, enabling organizations to focus on their core competencies and business objectives.

Moreover, BIN sponsorship offers organizations a robust framework for regulatory compliance and risk management. Licensed as financial institutions, BIN sponsors are well-versed in navigating the intricate web of regulatory requirements, including PCI DSS and other industry standards. By partnering with a BIN sponsor, sponsees can ensure adherence to compliance guidelines, safeguarding sensitive financial information and mitigating potential risks such as fraud and chargebacks. That’s one critical aspect taken care of right from the start.

Additionally, BIN sponsorship enables organizations to customize and tailor their payment solutions to align with their brand identity and customer preferences. From branded payment interfaces to personalized card designs, businesses have the flexibility to create unique and seamless payment experiences for their customers. This customization not only enhances brand recognition and loyalty but also fosters trust and confidence in the payment process.

Considerations for choosing a BIN sponsorship partner

Having explored its functions and benefits, let’s now delve into the factors to consider when assessing a potential partner. Below are the key considerations to weigh in:

- Regulatory compliance

Ensure the BIN sponsor complies with relevant financial regulations and standards, such as those set by card networks like Visa, Mastercard, or others. Compliance ensures the legality and legitimacy of your card issuance and transaction processing activities.

- Network access

Evaluate the sponsor’s access to major payment networks. The sponsor should have agreements in place with card networks to enable card issuance, authorization, and clearing services.

- Geographic coverage

Consider the geographical reach offered by your potential partner. While traditional BIN sponsors often adhere to a ‘one sponsor, one country’ model, partnering with Zenus Bank opens doors internationally, providing unparalleled access for your business expansion needs.

- Technology and infrastructure

Assess the sponsor’s technology infrastructure, including their card management system, transaction processing capabilities, and fraud prevention tools. A robust and reliable infrastructure is essential for seamless card issuance and transaction processing.

- Customization and flexibility

Look for a BIN sponsor that offers customization options tailored to your business needs. Flexibility in card design, pricing structures, and service offerings allows you to adapt to evolving market demands and customer preferences.

- Security measures

Prioritize security when selecting a BIN sponsor. Verify that the sponsor implements industry-leading security protocols and encryption standards to protect cardholder data and prevent fraud.

- Support and service level agreements (SLAs)

Choose a BIN sponsor known for responsive customer support and clear SLAs. Reliable support ensures prompt resolution of issues and minimizes disruptions to your card issuance and processing operations.

- Reputation and track record

Research the reputation and track record of potential BIN sponsors. Look for established institutions with a history of reliability, financial stability, and integrity in the payments industry.

- Cost and pricing structure

Understand the cost and pricing structure associated with BIN sponsorship, including setup fees, transaction fees, and ongoing maintenance costs. Compare pricing options across multiple sponsors to find the most competitive and cost-effective solution

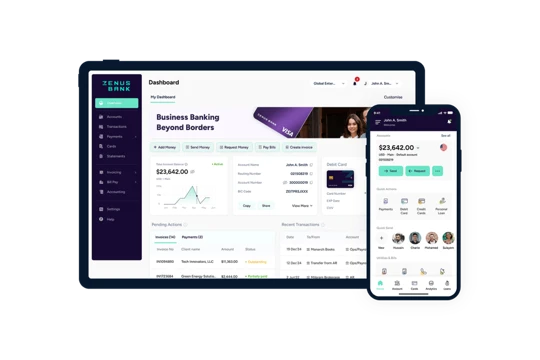

BIN sponsorship with Zenus Bank

The Zenus BIN sponsorship program offers a great opportunity for businesses entering the realm of payment processing. What distinguishes Zenus is its Visa Principal Membership and the capacity to issue cross-border, US dollar cards, empowering businesses to distribute US dollar cards internationally– a feature unparalleled in the market. With an emphasis on practicality and global reach, Zenus Bank ensures seamless access to international markets while prioritizing client convenience and regulatory compliance.

Zenus’ commitment to cutting-edge technology ensures seamless transaction processing and robust security measures. Moreover, Zenus simplifies regulatory complexities and accreditation procedures, allowing businesses to focus on strategic growth while navigating the financial landscape. With Zenus BIN sponsorship, businesses can quickly access new markets, generate revenue without requiring a banking license, and benefit from unmatched value and regulatory ease. This singular product stands out and offers clients a compelling incentive for use.

Conclusion

Selecting the appropriate BIN sponsorship partner is a critical decision for businesses venturing into payment processing. The right partner can streamline operations, enhance security measures, and facilitate seamless financial transactions. With the range of options available, it is imperative for organizations to conduct comprehensive evaluations based on objective factors. By prioritizing these considerations and partnering with a reputable BIN sponsor, businesses can effectively deliver remarkable experiences to their audience.

If you are interested in Zenus Bank’s own BIN sponsorship program, get in touch or read more here.