For freelancers and digital nomads, an independent lifestyle and the freedom to explore the world represent powerful aspirations. Zenus Bank recognizes the distinct challenges inherent in managing finances while on the move.

With a Zenus account, seamless access to the American banking system becomes a reality, allowing individuals to leverage the convenience and security of the US banking system even while living outside the US.

Challenges for freelancers and digital nomads

Pursuing an independent lifestyle and the thrill of travel often comes with unique financial challenges. We're dedicated to solving these and giving you the best banking experience, wherever you are.

How Zenus helps

Fast online application

Apply from 180+ countries, all done on your smartphone. Zenus Bank has revolutionized the process of applying for a US bank account, making it easy to do so from anywhere in the world, without the need to travel to the US or use intermediaries.

Affordable and convenient

A Zenus account is a true US bank account, not an e-wallet or prepaid account, which means you get full access to the US banking system. Zenus clients enjoy affordable, fixed fees for transfers as well as institutional rates for FX.

As such, you can make Wire, SWIFT, and Zenus Transfers (free transfers between Zenus accounts) without any hassle and you get to keep more of your money when you move funds into more than 40 currencies. Finally, Zenus imposes no limit on the value or volume of payments received/sent from your account.

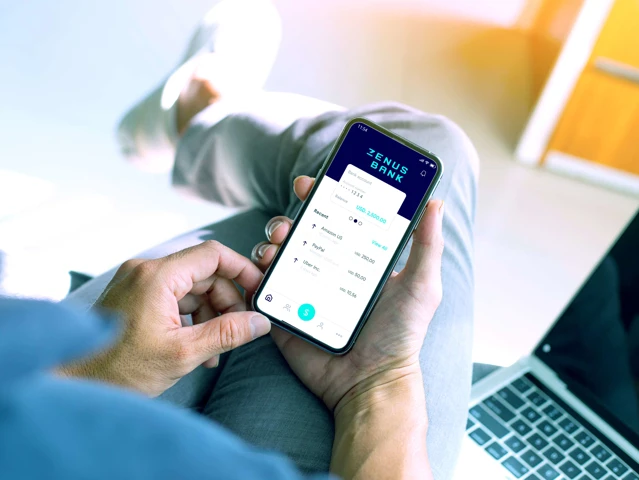

Seamless digital banking experience

Zenus offers a premium banking experience via its mobile app and online banking channels. With a user-friendly interface and advanced features, it allows users to manage their finances seamlessly. Customers enjoy real-time updates and notifications, and can effortlessly view their account balances, track transactions, transfer funds, and pay bills with just a few taps or clicks.

Peace of mind

We are a fully licensed and regulated US bank, which means you can rest assured that your funds are always safe, protected by the same stringent rules and regulations that protect American citizens.

In fact, your funds will be arguably safer with us than with most other banks because Zenus is a full-reserve bank, which means we never lend out or invest your money. As a result, you have uninterrupted access to your funds 24/7.

How to apply

3 easy steps to your Zenus Bank account

Have your documents ready before you start.

Install the Zenus Bank app and complete our application form.

We will let you know within 48 hours if your account has been approved.