Documents needed to apply

Like all banks we need to conform with Know Your Customer (KYC) procedures. To confirm who you are we need you upload the following during your application

As proof of your ID we will need you to scan a copy of your original, government-issued passport

The document must state the name of the applicant and the address that is being used in the application. Ideally it should match the passport as well. We only accept the following as a proof of address:

- Utility bill that is no more than 3 months old (water, electricity, cable tv, telephone, internet)

- Bank statement (no more than 3 months old)

- Valid driving license

- Lease/mortgage agreement

- Property tax receipt

- College enrolment papers

- Insurance card

- Voter registration card

- Valid government issued document (must be certified or stamped, include name, address, and date)

Documents that will be needed later:

Once you have completed your application you will need to provide the following documents:

Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding or Request for Taxpayer Identification Number (TIN) and Certification.

- If you are a not a US citizen, we require a completed W-8Ben form.

- If you are a US citizen, we require a completed W-9 form.

Any one of the following can be uploaded:

- A copy of your employment contract

- Employment verification letter

- Paystub/payslip

- Tax returns or forms for the last financial year

- A bank statement showing your salary being deposited into your account

- Unemployment benefit statement

- A pension distribution statement

Frequently asked questions

We've made opening an account with us as easy as we can, but we still need to complete all the regulatory and procedural checks required of a bank.

If you submit all your details correctly and meet our requirements your account application will be automatically approved at the same time you make it.

If we require further supporting information we will accept your application and then contact you by email within 48hrs (business days) to explain what we need.

The faster you reply to us, the sooner we will be able to provide you with a decision.

If there is no way we can open an account for you, your application will be declined. The most common reason for this is that you are located in a country we are prohibited from serving by our licenses and regulations.

If you require further information, please contact Client Services.

As part of the verification process for onboarding at Zenus bank you will need to provide a passport photo, a self portrait (selfie), voice recording, proof of address documentation (electricity, gas, water, landline, etc.) and your W-9 form if you are a U.S citizen or a W-8 if you are a non-US citizen.

No, there is no requirement to make a deposit to open an account or hold a minimum deposit in your account.

You will however need to make sure your monthly account fee is paid and that there is regular activity on the account, otherwise we will close your account.

A $50 application fee needs to be paid to establish you have sufficient funds. In the instance that your account isn't opened, we'll refund to the payment method used during your application.

After that there is a $19.99 monthly fee.

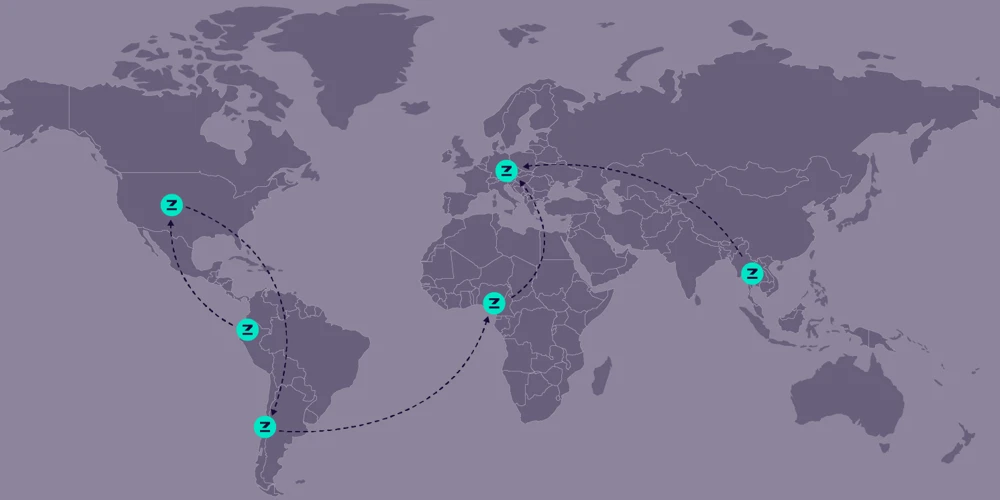

Your Zenus account is more than just a bank account. We like to think it will open up a new world for you. With our apps and online you can quickly and securely hold send and receive funds in a number efficient ways. You can make low cost domestic US payments, international transactions using SWIFT and move money for free between other Zenus members.

Additionally, your Visa Infinite debit card entitles you to a host of benefits including purchase and price protection, travel insurance, airport lounge access and a digital concierge. Check out our website for more information.

As long as you continue paying your monthly membership fee there is no limit to the length of time you can keep your funds securely with us. We operate as a full reserve bank, which means unlike other banks we do not lend your money to others. This ensures you can access all of it, all of the time.

No, we do not pay interest on current accounts. As a full reserve bank we hold all client money within the bank and do not use it to lend, invest or trade. We believe this is the safest form of banking but it also means that we cannot offer interest bearing accounts.

You can apply for Zenus membership with our iOS and Android apps and can use our Online Banking to log in to your account on a desktop, laptop or mobile device. Online banking can be used to make payments or deposits, check balances or change your details.

Yes, you can manage your virtual debit card using our apps or online banking.

They provide the option to see your card details, security code and to activate or block your card. We will use your voice or facial ID to authorize this access.

At the moment it's only possible to have one virtual card with your Zenus membership.

Zenus is not a member of the Financial Services Compensation Scheme (FSCS) or the Federal Deposit Insurance Corporation (FDIC). However, we follow a number of regulations, practices and policies to keep your money safe.

Puerto Rico is a US territory, not a US state. This means our IFE license gives us the ability to open bank accounts for people all over the world without needing to have a banking license in all of those countries or US states.