Understanding BIN sponsorship, Part 1

Technology

In the intricate global banking landscape, the Banking Identification Number (BIN) plays a pivotal role, serving as the foundation for various banking operations. Analogous to individuals having names and computers IP addresses, BIN numbers function as the distinctive identifiers that banks utilize for differentiation and self-identification. In recent years, a concept that has gained prominence within the financial sector is BIN sponsorship.

This innovative practice involves a distinctive collaboration between financial institutions and other entities, opening doors to novel possibilities and reshaping the financial services industry. At its core, BIN sponsorship entails a bank (the sponsor, who is a direct scheme member of one or several of the major card schemes, e.g. Visa) sharing its BIN with another organization (the sponsee). This collaborative endeavor facilitates the extension of financial services beyond traditional banking institutions, allowing entities like fintech companies or other enterprises to leverage the established infrastructure of a sponsor without the need for a banking license.

Understanding the basics of BIN

Before delving into the intricacies of BIN sponsorship, it’s crucial to understand the fundamentals of the Banking Identification Number itself. A BIN is the initial set of digits on a credit card, debit card, or any other payment card. It serves as a crucial identifier, revealing information about the card issuer, card type, and even the geographic region where it has been issued. This information is vital for routing transactions accurately and ensuring the seamless global transfers.

Consider the consequences of an inaccurate routing system. For example, we’re all familiar with the feeling of dialing someone by mistake. Now, imagine your dial being a money transfer sent to the wrong person. The significance of a precise routing system becomes even clearer in preventing such unintended and potentially serious errors.

What is BIN sponsorship and how did it emerge?

So, now that we know what a BIN is, we can start answering the question – what is BIN sponsorship and how did it emerge? BIN sponsorship is the result of a strategic partnership between a financial institution (a bank) and non-banking entities. Traditionally, BINs were exclusive to banks, with each bank having its range of numbers. However, with the evolution of the financial landscape and the development of the fintech sector, there has been a paradigm shift. Non-banking entities, such as fintech companies and payment service providers, started exploring opportunities to leverage BINs through sponsorship arrangements.

The reason is simple: obtaining a banking license and, consequently, your own BIN is a complex and lengthy process. In contrast, leveraging an existing bank’s BIN presents an attractive alternative. It is crucial to note that the Open Banking played a pivotal role in the emergence of BIN sponsorship. Open Banking, which mandated the sharing of a bank’s data with third-party financial service providers through APIs, spurred heightened collaboration between traditional banks and non-banking entities like fintech companies.

How BIN sponsorship empowers fintechs and enterprises

Within the present day fintech industry, BIN sponsorship plays an interesting role as a catalyst driving the growth and innovation of both fintechs and diverse organizations, and its role is poised to grow. This section explores the multifaceted ways in which BIN sponsorship contributes to the success and operational efficiency of these entities.

- Seamless integration and enhanced user experience

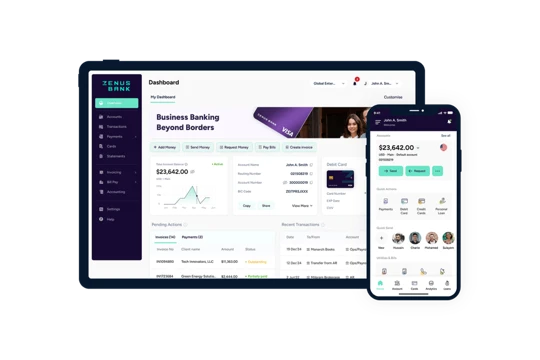

BIN sponsorship facilitates seamless integration of payment processes for fintechs and organizations. By obtaining their desired BIN, these entities gain the flexibility to tailor payment experiences to their specific needs. This customization ensures a more user-friendly and brand-aligned transaction environment, fostering trust and loyalty among users.

For instance, a fintech leveraging BIN sponsorship can design a streamlined payment flow within its app, providing users with a frictionless experience, from onboarding to completing transactions. This strategic advantage not only elevates user satisfaction but also positions the fintech as a forward-thinking industry leader, setting the stage for sustained growth.

- Accelerated time-to-market for innovative solutions

BIN sponsorship provides a significant advantage in speeding up the time-to-market for innovative solutions. Obtaining one’s own BIN is a time-consuming and resource-intensive process, involving regulatory hurdles and substantial costs. In contrast, leveraging a BIN sponsorship program offers a streamlined and expedited route.

This proves a real advantage for fintechs, for example, who can rapidly deploy cutting-edge solutions without the hassle of navigating the complexities associated with acquiring and managing their own BIN. This not only saves valuable time but also proves to be a more cost-effective solution. In essence, BIN sponsorship transforms a once intricate procedure into a commodity, enabling organizations to compete based on the excellence of their services and the novelty of their products.

- Robust compliance and security

BIN sponsorship ensures rigorous regulatory compliance and robust security, sparing the sponsee from the need to invest in an extensive and costly security tech infrastructure. The sponsor shoulders the responsibility for maintaining stringent security measures. This empowers entities, such as e-commerce platforms or any business, to benefit from advanced fraud detection mechanisms while focusing their go-to-market strategy/product strategy.

As we wrap up Part 1 on BIN sponsorship, we’ve covered the essentials – BINs, sponsorship emergence, and its impact. Stay tuned for Part 2, where we’ll explore the strategic advantages reshaping financial landscapes.