Payments-as-a-Service Explained

Technology

In the rapidly evolving landscape of financial technology, Payments-as-a-Service (PaaS) has emerged as a transformative solution, revolutionizing the way businesses handle transactions. In this blog post we will provide a comprehensive understanding of PaaS, delving into its definition, functionality, benefits, and the evolving trends in this dynamic sector of finance.

What is PaaS?

Payments-as-a-Service, is a cloud-based financial service that enables businesses to outsource their payment processing infrastructure to a third-party provider. Unlike traditional payment models, where companies had to invest heavily in building and maintaining their own payment systems, PaaS offers a more streamlined and cost-effective approach. PaaS providers manage the complexities of payment processing, including authorization, settlement, and security, allowing businesses to focus on their core competencies.

How PaaS helps businesses

1. Cost efficiency

One of the primary advantages of adopting PaaS is the cost savings associated with outsourcing payment processing infrastructure. Businesses can avoid significant upfront investments in hardware, software, and ongoing maintenance, leading to a more predictable cost structure. This predictability proves invaluable for budgeting and financial planning.

2. Scalability

Due to their as-a-Service nature, PaaS solutions are designed to scale effortlessly with the growth of a business. Whether a company experiences a sudden surge in transactions or plans to expand globally, a PaaS provider can adapt to changing demands. The result is a seamless and efficient payment processing experience, regardless of the business’ size and trajectory.

3. Enhanced security

Security is paramount in the world of payments, and PaaS providers understand this well. Heavy investments in advanced encryption, tokenization, and fraud detection technologies contribute to enhanced security. Businesses leveraging a PaaS solution can mitigate risks associated with payment processing, fostering trust among customers who are increasingly concerned about the safety of their financial transactions.

4. Access to advanced features

Usually, PaaS platforms come equipped with a plethora of advanced features and tools that businesses can seamlessly integrate into their systems. Real-time reporting, analytics, and customizable payment workflows empower businesses with valuable insights and flexibility. This high level of customization not only ensures that payment processes align precisely with the unique needs of each business but also enables them to better support the specific needs of end users.

Evolutions in PaaS

In the fast-moving world of fintech, Payments-as-a-Service stands at the forefront, seamlessly integrating with cutting-edge technologies to elevate transactional efficiency. After all, payments represent the movement of value. And as the creation of value accelerates and expectations for swift cross-border transactions rise, it’s only natural that the industry adapts to meet these demands and heightened expectations.

1. Advanced tech integration

PaaS is evolving to incorporate emerging technologies, prominently artificial intelligence (AI). AI-driven fraud detection and prevention mechanisms stand as a testament to this evolution, enhancing security measures and catering to businesses in search of sophisticated solutions for their payment processes. This not only fortifies the security infrastructure but also streamlines the overall payment experience for both businesses and consumers, marking a significant leap forward in the digital payment landscape.

2. Cross-border payments

With the globalization of businesses, PaaS providers are increasingly focusing on facilitating seamless cross-border transactions. By leveraging PaaS for international payments, businesses can overcome the complexities associated with different currencies, regulatory environments, and payment methods. This evolution is not simply about geographical expansion, but creating a seamless, interconnected financial ecosystem that enables businesses to thrive globally.

3. Tokenization

Tokenization is becoming a key feature in PaaS, replacing sensitive payment data with unique tokens. This enhances security by reducing the risk of data breaches and unauthorized access, providing an additional layer of protection for both businesses and their customers. Beyond security benefits, tokenization also contributes to the simplification of compliance processes, as businesses can navigate regulatory landscapes with greater ease.

Conclusion

In conclusion, Payments-as-a-Service is a model for outsourcing payment processing functions, and a game-changer in the world of financial technology. Its ability to streamline payment processes, reduce costs, and enhance security makes it an attractive solution for businesses of all sizes. Organizations looking to stay competitive and agile in the fast-paced world of finance would do well to explore the benefits that PaaS can offer.

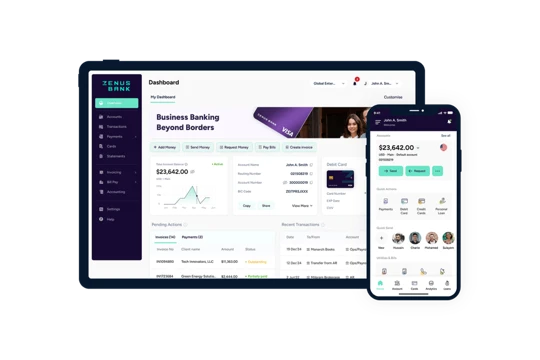

Zenus is a leading Payment Solution provider, with a range of payment processing services available. If you seek a dependable partner to address your payment needs, get in touch about our tailored payment solutions today!