Expand your business with a global card program

Technology

In today’s fast-moving financial landscape, offering a branded payment card isn’t just a nice-to-have — it’s a strategic and competitive differentiation.

Launching a truly global card program that seamlessly crosses borders and supports multiple currencies, requires more than ambition. It requires a strong, modern infrastructure, built through trusted partnerships and designed to support such an operation and deep understanding of the regulatory and operational landscape.

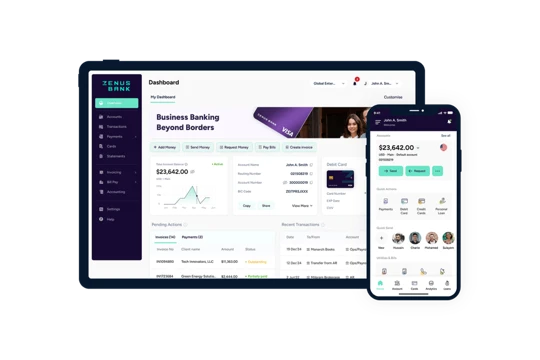

Zenus Bank empowers businesses and accelerates your ability to launch a global card program without the need for a local entity or banking license. By eliminating traditional barriers, we help businesses fast-track their entry into new markets, whether scaling consumer payments, embedding financial services, or managing cross-border transactions. With Zenus Bank, your organization can move swiftly, operate globally, and focus on growth from day one.

BIN Sponsorship explained

The BIN (Bank Identification Number) is the identification number that authorizes the issuance of cards and enables paticipation in card network transactions. The number identifies key details such as card type, card network and the issuing bank. The BIN ensures routing of transactions through the card network and through to the identified endpoint.

Only licensed financial institutions with principal membership in a card network can issue cards. These licensed banks such as Zenus Bank, can obtain and manage BINs that may be used under proper agreement by other businesses. As the sponsor, the bank provides access to the BIN, ensures compliance with regulatory and network requirements, and facilitates transaction settlement. A BIN sponsorship program enables organizations to offer their own “branded” payment cards, bypassing the complexity and cost of becoming a licensed bank.

Card issuance: the full ecosystem

Launching a successful card program involves much more than simply issuing physical or virtual cards. It demands the seamless integration of a well-structured ecosystem — combining regulatory compliance, robust technical infrastructure, and an exceptional customer experience.

Each component in the ecosystem plays a vital role in ensuring the program runs securely, efficiently and effectively at scale:

- Sponsor bank: the sponsor bank is the bank of record. The BIN assigned belongs to the bank which then provides use of the BIN to another business. The Sponsor bank maintains regulatory compliance and provides settlement services with the associated card network for any transactions and or card network fees.

- Issuer processor: a technology platform that powers card management services, handles transactions processing (including approvals and declines), provides reporting, and supports fraud prevention and balance checks by integrating with ledgers or core banking solutions.

- Card scheme (e.g. Visa): provides the card network, the branding and infrastructure to facilitate transactions and the movement of funds (domestic and international settlement agreements) and governs the rules for participation. The Card Scheme requires principal membership by a financial institution.

- Program manager: oversees the day-to-day operation of the card program, including cardholder onboarding, card issuance and embossing, customer support and marketing.

A flexible approach to card products

Every business is unique, with its own goals, markets, and customer experiences — and flexibility is crucial in card issuance. Whether launching a consumer product, managing payroll, embedding financial services into an existing platform, or facilitating cross-border transactions, your card solution must be tailored to meet the specific needs of your customer base and operational strategy.

Card programs come in various forms to suit different needs:

The key is to choose a solution that supports your company's strategy, rather than adjusting your strategy to fit the limitations of your provider. A truly global card issuing partner should offer flexibility—not in the types of cards, but also in how you issue, manage, and scale across international markets.

Selecting the right partner

Selecting the right BIN sponsor is crucial. In addition to issuing capabilities, a partner must provide regulatory strength, operational flexibility, and global reach.

Zenus Bank offers a comprehensive, global approach to card issuance, tailored for businesses with an international mindset from the outset. As a Visa Principal Member and a licensed International Financial Entity (IFE), we are uniquely authorized to sponsor BINs and issue USD-denominated cards that work seamlessly across borders. This enables our clients to launch card programs swiftly and compliantly, without the need for local incorporation or banking infrastructure.

Our flexible model gives clients the option to use their preferred issuer processor or integrate with one of our trusted partners. Zenus also enables businesses to act as Program Managers, maintaining full control over their brand, operations, and customer experience—while benefiting from our expert guidance at every stage.

Whether you're issuing debit, credit, prepaid, payroll cards, Zenus provides the infrastructure and regulatory framework to deliver a secure, modern user experience. Our USD card issuing model simplifies local currency management complexities and allows you to offer a stable, globally accepted financial product.

Final thoughts

Issuing payment cards globally goes beyond just a great idea. It demands a trusted partner with the right experience, infrastructure and licenses to launch your product quickly while maintaining security and compliance.

Zenus Bank simplifies the complexities of global card issuance, giving you the freedom to focus on growth. Our BIN Sponsorship Program is designed for companies that think beyond borders and want to offer their customers a truly international financial experience.