Developments in digital payments – security & privacy

Technology

The world of digital payments has witnessed remarkable growth and development over the last decade and a half, with technology playing a pivotal role in transforming the way transactions are conducted globally. As such, international money transfers are more common than ever, digital banks are serving digital-first consumers, and contactless payments are ubiquitous.

Moreover, there is a noticeable uptick in the overall pace of innovation, granting an increasing number of individuals access to progressively advanced products and services in the payments sector. In this blog post, we will delve into the security and privacy aspects of digital payments, exploring novel developments that are shaping the future of financial transactions.

New security developments in digital payments

Advancements in digital payments are steering the financial landscape towards unparalleled innovation. From continuous authentication strategies to the integration of generative AI in fraud management, the advancements that are currently gaining ground at the edge of the field are revolutionizing security and efficiency.

Needless to say, security and fraud prevention have always been a significant topic in this space. However, with digital payments coming to dominate our world, the imperative to fortify these measures has reached unprecedented heights. The surge in digital, mobile, and social commerce channels has created new opportunities for malicious activities, leading to a significant rise in fraud-related costs for businesses. Here are key developments in fortifying security for digital payments:

- Advanced identity verification systems

To address these challenges, businesses are strategically integrating advanced technologies, notably AI-driven solutions and sophisticated identity verification systems. These systems represent a paradigm shift in how user identities are authenticated. Rather than relying solely on traditional methods, such as passwords or one-time verification codes, advanced identity verification employs multifaceted techniques.

This includes a combination of biometrics, behavioral analytics, and document verification. Biometric factors, such as fingerprint, voice, or facial recognition, provide a unique and secure means of confirming a user’s identity; meanwhile, behavioral analytics analyze patterns of user behavior, adding an extra layer of security by recognizing deviations from the norm. Additionally, document verification ensures the legitimacy of identity documents, further enhancing the overall robustness of the verification process. The result of this mix of systems marks a crucial paradigm shift in authentication methods, not only strengthening security measures but also contributing significantly to building consumer trust.

- Continuous authentication

Continuous authentication is an important aspect of this strategy, going beyond conventional methods by verifying identity throughout an entire session. So rather than relying solely on a single point of authentication, continuous authentication constantly reassesses and verifies the user’s identity at various touchpoints during their interaction. This proactive approach serves as an effective deterrent against unauthorized access, greatly reducing the risk of fraudulent activities.

As consumers navigate every touchpoint of their buying journey, continuous authentication seamlessly envelops them, leveraging data and intricate scoring mechanisms. For example, it may consider factors like the device being used, geolocation, and even subtle behavioral cues, ensuring a dynamic and adaptive layer of security. Combining continuous authentication with advanced identity verification not only tackles the current challenges in digital commerce but also foresees and counters potential threats throughout the entire transaction process.

- Generative AI in fraud management

The integration of generative AI is another instance of an advanced development in the digital payments space, with implications particularly in fraud prevention and credit extension. Businesses are utilizing generative AI and machine learning to enhance fraud management. This involves making real-time decisions, continuously refining detection models, and implementing proactive measures against phishing, bulk email attacks, and behavioral anomalies during transactions.

Despite these benefits, it is worth noting that fraudsters are also adapting to these technologies. And indeed they use them in sophisticated, creative ways such as for well-constructed phishing attempts and bulk email attacks. The evolving landscape emphasizes the constant battle between businesses and criminals in a world where the tools get more powerful, the stakes get higher, and businesses cannot afford to sit on the sidelines.

- Neural networks and fraud graphs

Coordinated digital fraud often involves groups of individuals hiding behind multiple digital identities. To combat this, emergent technologies based around graph database solutions are increasingly being adopted as a countermeasure. A graph database utilizes graph structures, such as nodes and edges, to represent and store data relationships. This enables efficient retrieval and analysis of interconnected information.

Neural networks combined with fraud graphs provide a powerful tool in unraveling the intricate web of fraudulent activities. More specifically, they are used to create fraud graphs that map relationships between multiple people involved in fraudulent activities. This innovative approach untangles the complexity inherent in such scenarios, assisting organizations and law enforcement in identifying and apprehending individuals behind the attacks. By mapping relationships between various data points, businesses can gain insights into the modus operandi of fraud networks and proactively thwart coordinated digital attacks.

Innovation vs essentials

The innovations we explored above represent an important shift in securing financial transactions for the future, recognizing the escalating need for robust digital security. Yet, amid these groundbreaking advancements, it’s essential to acknowledge the effectiveness of more foundational security measures. Multifactor authentication (MFA), encryption, network tokenization, while not cutting-edge per se, still play vital role in the ongoing security of the payments ecosystem – and will continue to play one for a long time.

As we chart the course of digital payments, financial institutions and businesses must recognize the enduring value of these proven security strategies. The bottom line is that balancing innovation with fundamental measures is paramount to building a robust defense against digital threats, maintaining trust in our quickly evolving industry.

Conclusion

To sum it up, digital payments demand continuous innovation in security measures. As more and more value is exchanged via digital means, businesses, from small to multinational, must prioritize security as a core competency. Leveraging advanced security protocols, procedures, and technology is crucial for ensuring the continued growth and prosperity of all – consumers, merchants, financial institutions – involved in the humble but all-important digital payment.

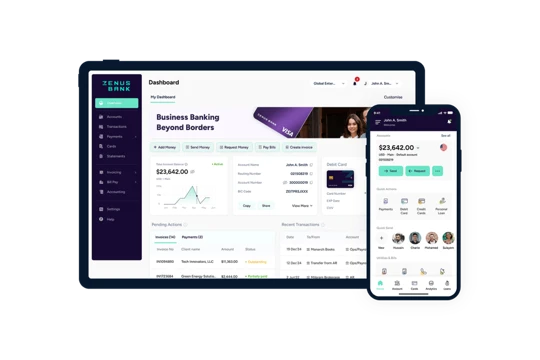

Since we are on the topic of payments, at Zenus, we’re not just working hard to take banking beyond borders. We’ve recently also started offering a state-of-the-art Payments platform tailored to meet all your processing and payment acceptance needs. Powered by innovative and robust security features, our payment solutions are certain to take your business to the next level. Learn more here.