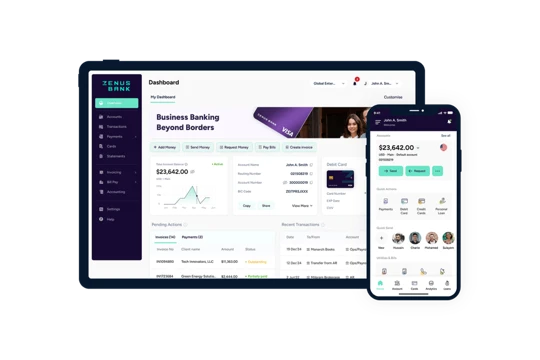

Banking beyond borders: Supporting seamless cross-border payments

Technology

In today’s interconnected global economy, the demand for cross-border payments is rapidly expanding. With global trade and international transactions on the rise, the need for efficient and secure cross-border payment solutions is more critical than ever. At Zenus, our mission is to enhance access to economic opportunity by providing cutting-edge banking and payment solutions, so we recognize the significance of this challenge and are committed to addressing it directly.

In this blog post, we’ll look at some key insights on the topic of international payments and consider ways to improve the flow of cross-border funds. Moreover, we will examine how Zenus is aligning with these recommendations to provide innovative solutions that meet the evolving needs of businesses and individuals engaged in international transactions.

Unlocking regulatory interoperability

As transactions and economies become increasingly interlinked, regulators must prioritize cross-border payment interoperability to ensure trade competitiveness and economic growth. Zenus understands the importance of this aspect and actively supports the call for unlocking regulatory interoperability.

To achieve this goal, we have adopted a comprehensive approach that includes adopting leading technologies, promoting transparency, and improving transaction efficiency. We are doing this while at the same time managing risks very diligently and also addressing user needs. By setting high quality standards in cross-border payment interoperability and onboarding clients from traditionally underserved countries, Zenus is laying the foundation for a more active, interoperable global payment system.

Strengthening regulatory cooperation

Regulators play a crucial role in driving regulatory cooperation for cross-border payments. Our organization acknowledges the significance of aligning standards across jurisdictions. This is key to reducing barriers to innovation and improving oversight coordination.

To this end, as a proud signatory of the UN Principles for Responsible Banking, Zenus actively engages with regional and international organizations and promotes global regulatory coordination efforts. By entering into digital economy agreements to commit to global standards and interoperability, Zenus ensures that its services are consistent, secure, and competitive in the international finance landscape.

Modernizing regulatory frameworks

In a rapidly digitalizing world, regulatory frameworks must evolve to keep pace with the ever-changing financial services landscape. Zenus supports a hybrid model combining entity-based and activity-based approaches, adhering to principles like “same activity, same risk, same regulation” and proportionality, as defined by the World Economic Forum. This approach ensures that regulations are tailored to the specific activities carried out, reducing regulatory arbitrage, and promoting consistent standards.

Furthermore, Zenus is dedicated to delivering products that empower businesses and end-users, making it effortless to transfer funds using modern, secure payment rails. Our goal is to reduce costs and ensure unparalleled convenience by bringing together a wide array of originators, including individuals, businesses, and government entities, with a variety of endpoints available, such as bank accounts, mobile wallets, cards, and cash-out locations.

Zenus also eliminates regulatory barriers, enhancing the efficiency of cross-border transactions by enabling non-bank Payment Service Providers (PSPs) to compete effectively and reduce costs for consumers. This commitment fosters financial inclusion and healthy competition in the international payments ecosystem.

The Zenus advantage

Zenus was founded with a vision to take banking beyond borders and enable customers to transact seamlessly across the globe. Here’s how we align with this mission:

- Effective cross-border payment solutions

Zenus prioritizes cross-border payment interoperability, ensuring that customers can conduct international transactions without friction. The bank’s services are designed to be inclusive, considering the unique needs and circumstances of users worldwide.

- Global regulatory coordination

Zenus actively engages in regulatory coordination efforts and cooperates extensively with authorities to safeguard the highest level of security and regulatory adherence. We are keen to ensure our services adhere to international standards and provide a consistent experience for users, regardless of their location.

- Cutting-edge technology

In a rapidly evolving financial landscape, Zenus leverages advanced technology to offer secure and efficient cross-border payment solutions. This commitment to innovation ensures that customers can trust Zenus for their international financial needs – now and in the future.

Conclusion

As the global economy becomes increasingly interconnected, the demand for efficient and secure cross-border payment solutions is paramount. Zenus, with its unwavering commitment to enhancing access to economic opportunities, recognizes the importance of addressing this challenge. With a focus on effective cross-border payment solutions, global regulatory coordination, and cutting-edge technology, Zenus continues to push the boundaries of what’s possible in the world of international finance.