Revolutionizing global banking

Zenus Bank is redefining global digital banking by providing seamless access to US financial services. Through our collaboration with Tuum and Purpleplum, Zenus had built a robust fintech platform that integrates advanced core banking capabilities with an intuitive, user-centric digital experience. This strategic partnership enables institutions worldwide to leverage our infrastructure and offer new financial solutions to their customers.

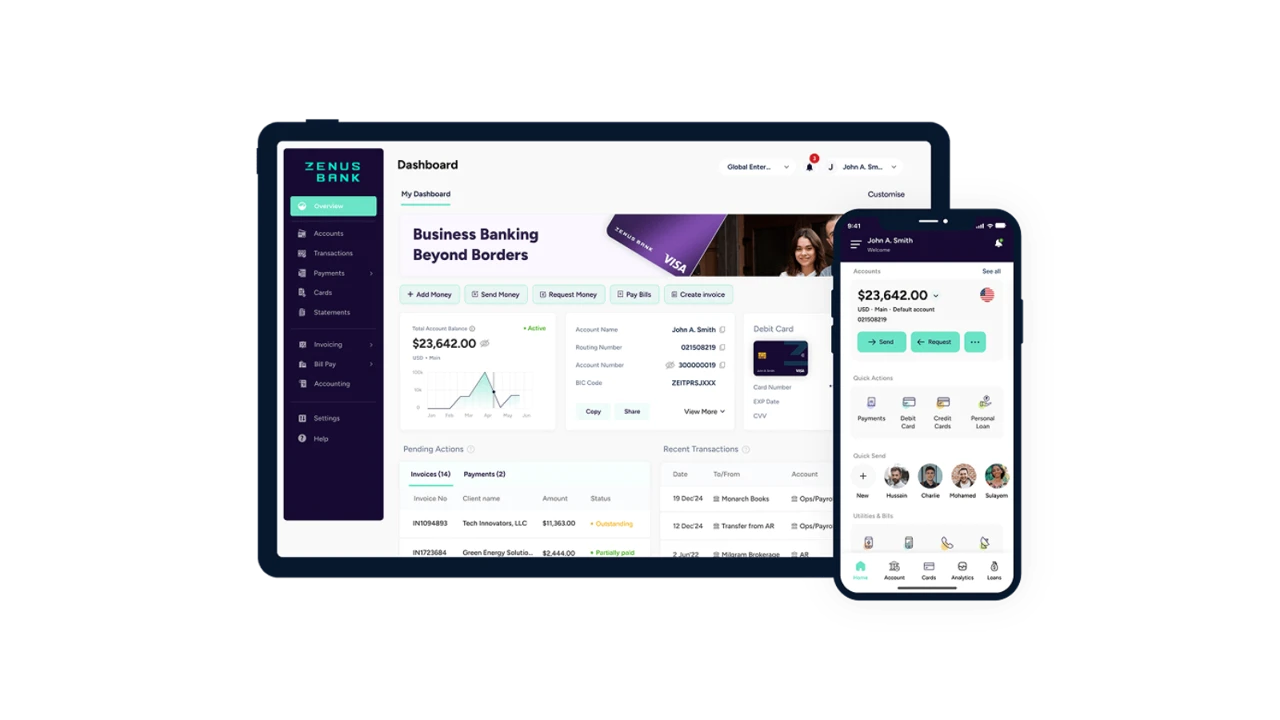

Launched as a mobile-first digital bank, initially focusing on retail customers to validate our innovative model. As we transitioned towards becoming an infrastructure bank, our goal was to enable financial institutions (FIs) to leverage our fintech platform for embedded accounts, cross-border card issuance, and various payment rails.

“The synergistic integration of Tuum and Purpleplum into the Zenus Fintech platform has been instrumental in exposing our unique infrastructure for other institutions to create new financial experiences for their customers.”

Key challenges

Scalability & flexibility

Ensuring flexibility for scalability was paramount to manage the growing international transactions and a significant increase in the customer base efficiently.

Regulatory compliance

Navigating the increasingly complex and stringent regulatory frameworks required in multiple countries was essential to global expansion.

Customer interactions

It was crucial to provide a personalized and seamless banking customer experience that could meet the expectations of a global customer base.

Strategy

Three core pillars of innovation

Zenus Bank conducted a rigorous selection process, using a proprietary scorecard to evaluate potential partners based on financial stability, technological innovation, and alignment with its long-term vision.

The bank selected:

- Tuum for its modular, cloud-native core banking system, ensuring flexibility and regulatory compliance.

- PurplePlum for its cutting-edge omnichannel digital platform, providing an intuitive and customizable user experience.

Together, Tuum and PurplePlum enabled seamless integration of:

- Virtual accounts similar to European IBANs.

- Domestic and international payments, P2P transfers, and card management.

- Advanced financial automation tools for corporate expense management and compliance.

A key aspect of this partnership was the API-first architecture, allowing real-time data synchronization, middleware orchestration, and scenario-based testing to ensure performance reliability. PurplePlum’s low-code adaptability also allowed Zenus to rapidly deploy new features in response to market demands.

Partnership & collaboration

Zenus decision to work with Tuum and Purpleplum was not just about technology—it was about finding partners who shared our commitment to innovation and excellence. This collaboration went beyond a traditional vendor-client relationship; it became a true partnership.

“What stands out most is the strong sense of partnership. From start to finish, we worked as one unified team, ensuring seamless collaboration across all aspects of the integration.”

Results & impact

Fast & efficient development

The core system was fully integrated within 12 months, exceeding industry standards.

Enhanced customer experience

The combination of Tuum’s core banking and PurplePlum’s user-centric interface increased engagement, retention, and operational efficiency.

Expanding banking services

Zenus expanded globally with advanced payment solutions, strengthening its role as a leader in embedded banking.

Through strategic partnerships with Tuum and PurplePlum, Zenus Bank has redefined the digital banking landscape. Their cloud-native, API-driven approach has set a new industry benchmark, demonstrating the power of collaborative fintech innovation.

Let's start building

Empower your institution with Zenus Bank's seamless integration. Manage US accounts effortlessly for clients worldwide.