What are fintech solutions for banking?

Technology

In the ever-evolving landscape of finance, technology continues to reshape the way we interact with our money. One of the most notable advancements over the past decade is the emergence of fintech solutions for banking. These innovations have not only transformed the traditional banking experience but have also opened the door to financial services for a wider audience. Innovations in this area include mobile banking apps, digital wallets, robo-advisors, and others.

Fintech banks

Fintech banks, also known as digital banks or neobanks, have gained significant traction over the years. These banks usually operate entirely online, without physical branches, and offer a range of financial services. They leverage technology to provide clients a seamless, user-friendly, and often more cost-effective banking experience.

One of the primary advantages of fintech banks is their accessibility. Traditional banks often require customers to visit a physical branch to open an account. In contrast, fintech banks allow you to create an account entirely online, making it easier and more convenient for customers to get started.

Is Zenus Bank a fintech bank?

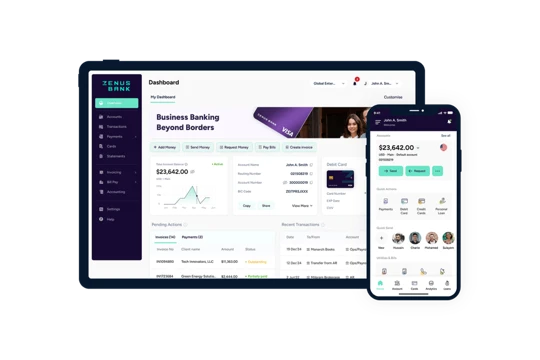

Here at Zenus, we’re closely acquainted with the need for and challenges of onboarding clients remotely. After all, ensuring full regulatory compliance while offering US bank accounts in more than 180 countries worldwide has been the defining achievement of our organization. It’s safe to say that, as a digital-only bank, we share many features with fintech banks, though we don’t identify as one.

The reason is that what the mainstream public often refers to as a fintech bank is typically not a bank at all, but rather a payment service provider. In contrast, Zenus wants to emphasize that we are a fully-regulated US bank with a complete banking charter – nothing questionable here. We operate on a full-reserve model, adhere strictly to all relevant US banking regulations, and we prioritize the security and financial wellbeing of our customers as a fundamental part of our mission.

The advent of Banking-as-a-Service

In the realm of fintech solutions for banking, perhaps the most noteworthy development in recent years is Banking-as-a-Service (BaaS). BaaS is basically an approach whereby banks extend their capabilities to third-party organizations, allowing them to integrate banking services into their own products and platforms.

BaaS essentially serves as a bridge between banks and fintech companies. It empowers businesses to leverage the core banking functions of established financial institutions without the need to build a bank from the ground up. This can include services like account creation, payments, lending etc.

Zenus and the future of BaaS

Zenus, the fintech arm of our group, is actively developing a BaaS platform as part of our strategy to maximize consumers’ exposure to our products. This platform will enable other organizations to utilize our banking infrastructure and embed banking services seamlessly into their offerings. By doing so, we aim to facilitate the expansion of financial services and the development of innovative products for consumers worldwide.

The concept of BaaS holds immense potential for promoting financial inclusion, as it allows businesses to reach a broader audience with banking services. It also fosters innovation by enabling fintech startups to focus on creating unique customer experiences rather than building complex banking infrastructure from scratch.

As the fintech industry continues to evolve, we can expect BaaS to play a pivotal role in shaping the future of financial services. It opens new avenues for collaboration, encourages the development of specialized financial products, and ultimately benefits consumers by providing access to a wider range of financial solutions.

Conclusion

The fintech revolution has brought about significant changes to the financial industry, offering greater accessibility, convenience, and innovative features. At Zenus, we exemplify this transformation by enabling clients to open US bank accounts from more than 180 countries. Additionally, our fintech division is actively developing a BaaS platform that will allow organizations to integrate our banking capabilities into their products, ultimately enhancing the services available to consumers.

Whether you’re looking to simplify your banking experience, explore investment opportunities, or establish a US bank account from afar, fintech solutions are likely to play a pivotal role in your financial journey.