Unlocking global access with Embedded Accounts

Technology

In today’s globalized, digital-first world, consumers and businesses expect financial services to be fast, seamless, and accessible—regardless of geography. At the same time, the U.S. dollar remains the world’s most trusted and widely used currency for international trade, investment, and savings.

Access to the U.S. financial system has long been a privilege reserved for a few. Regulatory complexity, high compliance standards, and infrastructure requirements have historically made it difficult—if not impossible—for non-U.S. residents to access American banking services directly.

That’s changing. As financial ecosystems evolve and technology opens new possibilities, embedded accounts are emerging as a powerful tool to bridge the gap. This article explores what embedded accounts are, why they are gaining momentum, and how forward-thinking institutions can use them to create a competitive advantage.

What are Embedded Accounts- and why do they matter?

Embedded accounts refer to bank accounts that are integrated directly into non-bank platform or application. This integration allows businesses to offer banking services—such as account creation, fund management, and payments—within their own environments, enhancing user experience and engagement.

In many regions, especially emerging markets, businesses and individuals face persistent barriers to global financial services. Currency volatility, political instability, and limited access to efficient international payment systems make accessing U.S. dollar accounts and cross-border payment solutions especially difficult.

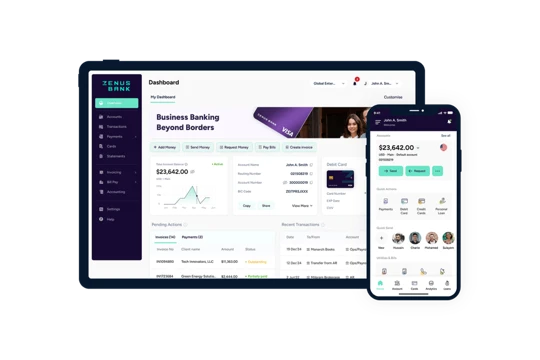

At the same time, end-user expectations continue to evolve. They want faster, simpler, and more transparent financial services- ideally delivered through platforms they already use. That’s where Zenus’ Embedded Accounts come in. By integrating regulated, cross-border banking services into local apps, platforms, and institutions, embedded accounts bridge the gap—without requiring users to visit a can physical bank or open a traditional account abroad.

Unlike traditional correspondent banking, where multiple intermediaries can introduce risk and reduce transparency, embedded banking enables direct access to regulated financial infrastructure. This reduces the risk of fraud, delays, and compliance gaps—making it a safer and more controlled way to access cross-border financial services.

Why Zenus is different: Embedded Banking, reimagined

Most embedded finance providers act as intermediaries- they connect partners to third-party banks or rely on multiple partners to deliver a fragmented solution. Zenus takes a different approach.

As a U.S regulated bank and Visa Principal Member, Zenus offers direct access to real U.S. account numbers, routing numbers, and global payment rails including FedWire, SWIFT, stablecoins, foreign exchange, and more. Zenus partners can launch branded financial services quickly, while we manage all backend complexity: compliance, risk management, KYC/AML, transaction monitoring, and infrastructure maintenance.

With Zenus B2B2C model, financial institutions, fintechs, and platforms can create and manage individual U.S. accounts for their customers—branded under their own name—with Zenus operating quietly in the background. Partners can focus on user experience while we handle the compliance and banking.

Who can benefit from Embedded Accounts?

Embedded accounts are valuable for organizations looking to offer seamless, compliant, and scalable financial services to their customers—without needing to become a licensed bank.

- Fintech startups can go to market with core banking features from day one.

- Traditional banks can expand cross-border capabilities.

- Global platforms- marketplaces, gig economy platforms, and enterprise software providers- can unlock essential financial features within an existing digital experience.

Zenus enables this through secure API integration. Each customer is onboarded via the partner’s branded front-end, while our automated workflows manage the compliance process in the background. Once verified, users receive their own U.S. account details—as if they’d walked into a bank in New York.

Compliance and scalability built in from the start

Compliance is one of the key pillars at Zenus. Our embedded platform is built to handle the regulatory complexities of global banking, while giving our partners the freedom to grow. Zenus team manages end-to-end KYC and AML processes, monitors transactions in real time, and provides reporting that complies with local and international regulators.

As partners organization grow, Zenus infrastructure scales with them. We’ve built our platform to support high-volume onboarding, real-time processing, and multi-region deployments. Whether a partner operates in five markets or fifty, they’ll have a reliable and compliant backbone to build on.

Conclusion

Embedded accounts are more than a technical feature—they are a strategic differentiator. By offering banking capabilities directly within a partner’s product, they increase user engagement, unlock monetization opportunities, and collect valuable financial insights. Services like payments, balances holding, and FX conversion can become a part of a partner’s revenue stream.

Most importantly, embedded accounts let institutions scale faster. With Zenus as partners, organizations can focus on growing their customer base, launching in new markets, or adapting to regulatory changes—without the need to build a global banking infrastructure from scratch.