Transforming Global Finance with Zenus Infrastructure

Technology

Access to modern financial services remains highly uneven across the globe—especially for businesses and individuals in emerging markets. In many of these regions, access to U.S. dollar accounts and cross-border payment solutions is limited by regulatory complexities, high fees, and inadequate infrastructure. Currency volatility, political instability, and inefficient international payment systems further complicate matters for local banks, fintechs, and the communities they serve.

At Zenus Bank, we believe this status quo is no longer acceptable.

A platform built for inclusion

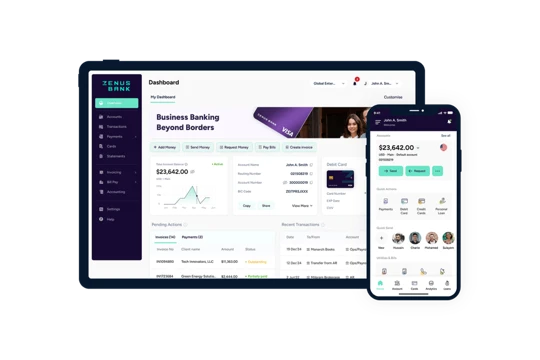

Zenus Bank was created to give people and businesses around the world access to secure, modern U.S. banking products—regardless of where they live. As the infrastructure bank behind this transformation, Zenus enables regulated institutions, fintechs, and traditional banks to integrate U.S. dollar accounts, global payments, and Visa card issuance directly into their platforms—without the need for a physical presence in the U.S. or complex correspondent relationships.

This embedded infrastructure allows partners to expand internationally, launch products faster, and serve underserved markets with secure, borderless financial services—driving access and inclusion at scale.

Working with partners to reach the underserved

The Zenus platform is already in use across diverse regions, including countries in Africa and Latin America, where it enables banking alternatives for previously underserved populations. By removing the need for heavy infrastructure investments or reliance on fragmented correspondent networks, Zenus allows partners to launch and scale global products faster, while reducing operational risk.

Zenus provides everything through a single, compliant platform— giving partners the ability to issue Visa cards, offer to U.S. accounts, and process international payments seamlessly. This helps eliminate reliance on informal or inaccessible options and brings consistency to regions where financial access has historically been fragmented.

Building a more inclusive financial future

Embedded banking is reshaping the financial landscape. By providing institutions with the infrastructure to deliver global financial services, Zenus is breaking down barriers that have long kept entire communities from fully participating in the global economy.

Zenus’ embedded platform goes beyond technology—it’s a strategic step toward financial equity. As we grow through purposeful partnerships, we remain committed to the individuals and communities at the heart of our mission.

From global fintech innovators to local microfinance institutions, partners are using Zenus to offer services that are secure, borderless, and built for the real-world needs of their clients.

A commitment to global goals

Zenus Bank’s mission goes beyond technology. Through our partnership with the United Nations Environment Programme Finance Initiative (UNEP FI), we’re advancing a more inclusive and equitable financial system. This collaboration reflects our core values: empowering the underbanked through accessible financial services, promoting gender equality by enabling women’s economic independence, and reducing global inequalities by supporting financial access and economic mobility. Together, we’re helping shape a financial future that works for everyone.

The UNEP FI collaboration underscores our long-term commitment to building an ethical, inclusive, and sustainable financial system. Our efforts to deliver banking services to underserved regions reflect UNEP FI’s vision of aligning the financial sector with sustainable development goals.

We recognize that financial inclusion is a key driver of economic growth and opportunity. As we expand our global reach, we’re focused on helping underserved communities—especially underserved communities and small business owners in volatile economies—gain access to the tools they need to grow, succeed, and participate fully in the financial system.