Quality matters: A closer look at the BaaS industry

Technology

Introduction

The world of financial technology is ever-evolving, with innovations like Banking-as-a-Service (BaaS) offering a gateway to efficient, secure, and flexible financial solutions. However, like any rapidly growing industry, BaaS is not without its challenges. Recently, a crisis involving Evolve Bank & Trust and Synapse has cast a shadow over the BaaS sector, raising concerns about its overall stability.

In this article, we’ll take a dive into the BaaS industry, its promises, and how disparate incidents should not define the entire landscape. We’ll also showcase how Zenus is actively redefining the space, leading the charge with its commitment to quality.

What is BaaS?

First, let’s get the basics out of the way. Banking-as-a-Service, or BaaS, is a model that allows non-banking entities to offer banking services to their customers. In essence, this B2B2C model that provides organizations with everything from account creation to transaction processing without the need to establish a traditional bank. This innovative concept empowers fintech companies and other businesses to extend financial services to their customers, offering a wide array of possibilities and advantages.

The promise of BaaS

The BaaS ecosystem holds the promise of revolutionizing how we interact with financial services. It offers an array of benefits, including:

- Speed & efficiency

BaaS accelerates the process of rolling out financial products, allowing businesses to rapidly bring their services to market. This is crucial in a world where time-to-market often defines success.

- Security

By partnering with BaaS providers, businesses can leverage the robust security infrastructure and practices of established financial institutions, ensuring the safety of their clients’ funds and data.

- Flexibility

BaaS gives businesses the freedom to customize financial services to meet the specific needs of their clientele. This flexibility is essential for businesses catering to diverse customer bases.

BaaS and recent challenges

Any industry has its challenges, and when an industry is especially fast-evolving and with the promises of great returns skewing risk perception, things are bound to go off the tracks. However, the recent crisis involving Evolve Bank & Trust and Synapse should be seen as a localized issue rather than a reflection of the entire BaaS sector. Just as in any other industry, there are reputable actors who take their responsibilities seriously, and there are those who fall short. As of 2023, the BaaS industry is thought to more than $5 billion. We should not judge an entire industry by the failures of one or two compromised organizations.

The banking industry, for instance, has faced its fair share of crises throughout history. Yet we don’t dismiss the entire sector because of those incidents. Rather, we scrutinize the players involved and demand transparency and responsibility in a targeted fashion, we create better processes to ensure oversight and improve financial stability. This principle should apply to the BaaS sector as well.

Leading the way in BaaS

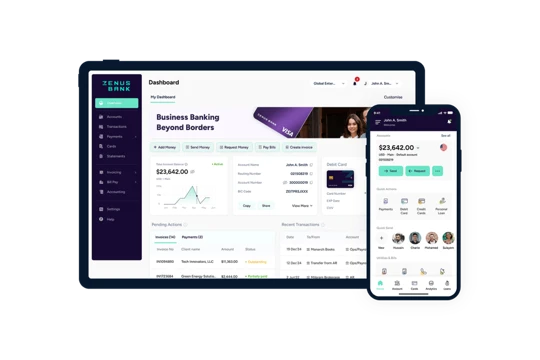

Here at Zenus, we are committed to being one of the reputable actors in the BaaS landscape. We recognize the significance of safeguarding our clients’ financial interests, and we have made substantial investments to build a robust technology infrastructure and establish mature security processes to ensure the safety of funds held with us.

Importantly, we’re not rushing to claim to be the first. Instead, we are methodically building a cutting-edge technology stack that prioritizes both speed and convenience alongside unrivaled security. Moreover, whereas some competitors may cut corners, Zenus makes it a point to adhere strictly to regulator’s guidelines because we see this as a long-term competitive edge.

The Zenus advantages

While the industry may encounter hurdles along the way, Zenus exemplifies a commitment to excellence and progress.

- Banking & fintech integration

Zenus bridges the worlds of banking and fintech, creating a seamless fusion of capabilities. This integration does not just reduce costs and streamline communication for our clients. It forges a deeper client relationship that allows us to respond with agility to their needs. Zenus offers a refreshing take on time-to-market, minimizing the bureaucracy that often plagues the financial industry.

- Security practices

Security is paramount in the financial world, and Zenus understands this implicitly. Our state-of-the-art technology for client identification and transaction authentication are second to none. Real-time supervision of all transactions and the application of machine learning algorithms for fraud detection ensure that our operations are fraud-free and your financial interests are protected, while keeping false alarms at a minimum.

- Innovation

Zenus doesn’t rest on its laurels. Yes, we were the first ever IFE license holder to be awarded a Visa Principal Membership, the first bank in the Caribbean to be awarded a Visa Direct Certification, and the first ever bank to be awarded by Visa the right to issues a premium Visa Infinite debit card (normally reserved solely for credit cards). But we have no plans to stop. By adding fintech services and working hard to expand and improve these products, we seek to continue pushing the boundaries of what is possible in the financial industry.

Conclusion

In conclusion, the most recent turmoil in the BaaS industry may very well not be the last. Nonetheless, it is key to treat it as the kind of event bound to happen in a growing industry and as a notice of the importance of choosing your partners wisely. These incidents are not indicative of the entire industry’s quality. Zenus is an example of a BaaS provider dedicated to excellence – building slowly, purposefully, prudently.

As BaaS continues to evolve and expand, companies must recognize the significance of thoroughly vetting their partners. Transparency, reliability, and security should be paramount when selecting a BaaS provider. While an isolated incident should not define an industry, it serves as a useful reminder of the importance of choosing quality and responsibility in what is and will remain a rapidly changing, transformative space. We invite organizations to explore the value we bring to the table and our commitment to the responsible growth of the BaaS sector.