How biometric solutions can transform cross border payments

Pedro Martinez, CIO & CICO, Zenus Bank

Technology

Cybersecurity and protecting customer safety and their finances online is never far from the headlines, and nowhere is this more important today than for banks and financial institutions.

The rise of challenger and neo banks, as well as fintech providers, has transformed the capabilities of the banking sector, which can now offer a vast array of services to customers. These include new interactive service models, ranging from cryptocurrencies, Buy Now Pay Later (BNPL) products and embedded financial lending services from companies across various sectors – ranging from supermarkets to global sports companies – outside of the banking industry.

The advent of new financial providers and innovative ways of banking means that while customers and businesses have many more options and financial mechanisms at their disposal, the opportunity for cyber-attacks, cases of fraud and money laundering is evening more prevalent. Targeted attacks on financial services organisations were uncommon 20 years ago. However, as skills and capabilities of network infiltration have evolved, the number of occurrences has grown in recent years, presenting significant challenges as the cultivation of trust and credibility is at the heart of banking.

In fact, according to the Financial Crime Report for the second quarter of 2022, online attack rates increased by 233 per cent. As cases of cyber-attacks rise, fighting against ever-changing online bank fraud has been more challenging than ever. In 2020, there was an 80 per cent increase in banks being fined in relation to money laundering.

For banks to remain competitive, seamless digital experiences aren’t enough. They also need to implement an effective bank fraud detection and prevention strategy in tandem to grow at speed. Otherwise, huge losses await, including both direct and indirect costs. Governments and industry-standard organisations are now seeking to regulate cyber-attacks by enforcing increasingly strict compliance criteria. But, sometimes, compliance regulations lag behind cybersecurity risk. As a result, firms must adopt a security-first strategy to cybersecurity in order to remain ahead of the shifting regulations.

Cross-border banking, for example, and the ability to transfer money across bank accounts from different countries, provide a unique challenge. While money has always been transferred across borders, the increase in cross-border flows of both capital and citizens in today’s world has resulted in more financial organisations providing this service. Furthermore, with the rise of international banking licences – the concept of globally-focused banks running on the same technology infrastructure across each country under one licence – cross-border banking can now be provided instantly and seamlessly. Banking accounts can be opened remotely and accessed from anywhere, providing customers with a global footprint, constant access to their funds and providing access to a global account for those in developing countries with less stable economies.

This new way of banking, however, inevitably poses a financial risk to anti-money laundering if the appropriate measures are not implemented effectively. Banks and other financial institutions must strive to implement strong AML measures – ensuring each account can authenticated through a rigorous due diligence process – whilst providing a seamless service for customers looking to transfer their funds across borders. Since banks worldwide mediate millions of transactions throughout the day, these institutions are at a higher risk of financial crimes. Banks must identify the risks by fulfilling their AML obligations and taking necessary precautions. The AML process is critical for the future financial and reputational standing of banks.

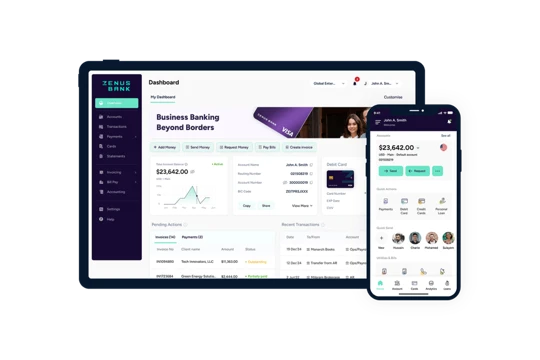

Therefore, the focus for new banks, such as Zenus, as well as existing providers re-defines banking chronology. Companies must ensure the latest AML technologies are in place before onboarding new customers or releasing new products.

Through the use of biometric solutions, cross border payments can happen succinctly and safely. Adopting systems such as the Customer Identification Program (CIP) has been key to achieving this. This technology streamlines the onboarding process for all our new customers using facial and voice recognition combined with artificial intelligence, all but eliminating the risk of individuals or businesses setting up fake accounts. CIP also validates thousands of identification documents in seconds, comparing the customer’s ID when submitting transactions to their facial recognition to provide financial security for us and our customers against money laundering. This type of full cycle integration of customer biometric validation and frictionless connectivity with multiple vendors is essential for financial irregularities and fraud prevention, as is eliminating old protection systems, such as the need for passwords, personal questions, or other weak links in the security chain.

With the ever-increasing demand for cross-border banking, real-time cybersecurity compliance is more important than ever. These systems will help define the safety of the global banking sector and will be essential in helping ensure financial systems can operate securely and provide stability, especially in emerging economies.

The finance sector must always strive to stay ahead of the ingenious ways criminals execute cyberattacks or financial fraud. Compliance in cybersecurity will go a long way in ensuring secure cross-border transactions and proactively identifying potential gaps in cybersecurity operations. But remember—Cybersecurity and Compliance are everyone’s responsibility.