Seamless digital payment acceptance

Zenus Payment Facilitation (PayFac) is an integrated payment processing solution that unlocks fast, secure, and seamless transactions, elevating customer experiences and increasing revenue. With robust security and efficient processing technology, PayFac simplifies payment acceptance, streamlines operations, and drives growth.

Fast approval, seamless onboarding

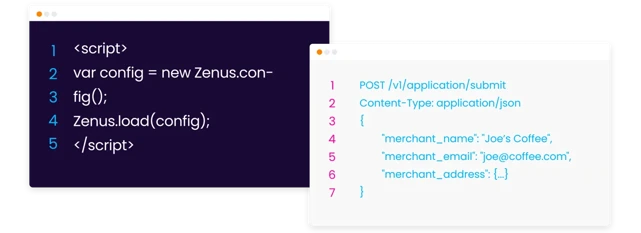

Experience unparalleled speed with Zenus. Get approved for an account in seconds and onboarded within an hour. With Zenus PayFac, accelerate your market entry and scale effortlessly. Our modern APIs and streamlined processes ensure a seamless transition from setup to transaction, cutting complexity and reducing overhead. Stay ahead with agility and efficiency at every step.

Secure payments, simplified

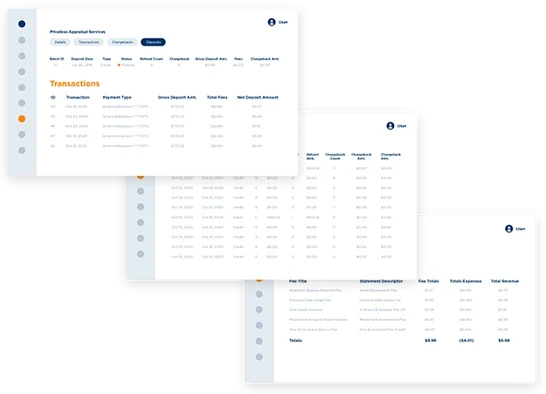

Dive into a seamless payment experience with Zenus PayFac’s rapid deployment, PCI Level 1 security, and robust reporting capabilities.

Our merchant portal helps you manage your transactions, address chargebacks with ease, and access insightful reports – all within a single, clear interface. This means you get streamlined account management, real-time transaction tracking, and actionable insights for unmatched efficiency.

USE CASES

Payment Facilitation

- Enable embedded payments and support all major credit cards/digital wallets.

- Heightened security with PCI DSS compliance, tokenization, encryption, and PCI 3DS.

- Secure card-not-present transactions for optimized online sales.

- Boost efficiency with ACH/SameDay ACH options for faster transactions.

- Pay with their preferred method – Visa, Mastercard, and others.

- Enjoy seamless shopping, making online and in-store purchases more convenient.

- Speed through checkout due to fast transaction processing.

- Experience piece of mind with leading payment security.

Frequently asked questions

A payment facilitator, also known as a payfac, is a solution that simplifies the process of enabling payment acceptance for merchants by aggregating and facilitating payment transactions on their behalf. A payment facilitator offers a more adaptable, efficient approach to payment processing compared to conventional merchant acquirers.

Traditional merchant acquiring involves time-consuming steps primarily linked to risk assessments. This includes a protracted application process that requires accompanying paperwork, manual underwriting, and a hard credit check, making it a cumbersome and inefficient procedure. On the other hand, Zenus PayFac expedites the process to mere minutes, removing the need for documentation and credit inquiries, and guaranteeing a smooth payment acceptance experience for clients.

Embedded payments seamlessly integrate the payment process into another application or platform, allowing users to make payments without leaving the application. This is a significant improvement over “integrated payments,” which historically caused brand disruption and led to enrollment abandonment.

Yes, Zenus PayFac provides embedded payments functionality. Our solution enables merchants to handle payments effortlessly and securely within their websites or applications while also eliminating concerns about any technical intricacies. PayFac delivers robust security, improved user experience, as well as enhanced customization and merchant control.

PayFac seamlessly integrates your business with global payment rails through modern RESTful APIs, advanced security, and strategic partnerships.

Leading technology:

- We utilize modern RESTful APIs for efficient connectivity to global payment networks.

- Strategic partnerships: Our alliances with major payment entities ensure both reliability and efficiency.

- Robust security: We employ encryption and tokenization, meeting industry standards like PCI DSS.

- Easy integration: Our design simplifies technical complexities, making it accessible for businesses of all sizes.

- Dedicated support: Our team provides human assistance for swift issue resolution.

By combining these elements, PayFac guarantees secure and straightforward integration with the world’s leading payment infrastructures.

PayFac is a state-of-the-art solution that empowers ISVs and SaaS (Software-as-a-Service) vendors to seamlessly incorporate payment acceptance into their products and platforms. Our onboarding process is exceptionally efficient, allowing for rapid deployment with zero risk and underwriting processes for the payment facilitator.

Security wise, Zenus PayFac provides a highly advanced solution. We utilize PCI-validated P2PE to ensure end-to-end encryption, guaranteeing the security and compliance of your transactions. Furthermore, our advanced tokenization technology offers maximum data protection by having your software platform store tokens instead of sensitive card data.

PayFac offers greater control over the payment process, enabling customized solutions. To learn more, visit our comprehensive API documentation and sandbox.