Cutting-edge money transfers

Zenus Fast Funds is a state-of-the-art money transfer service that enables real-time, international transfers. Our cloud-native solution, powered by innovative APIs, ensures top-level security, ease of use, and business growth.

Designed for adaptability and security, Zenus solution supports a wide range of global use cases. It ensures instant and secure international transactions, successfully addressing modern operational needs. Seamlessly integrating into various environments, it can be tailored to fit your specific use cases with ease.

Empowering your payments with speed, scale, and security

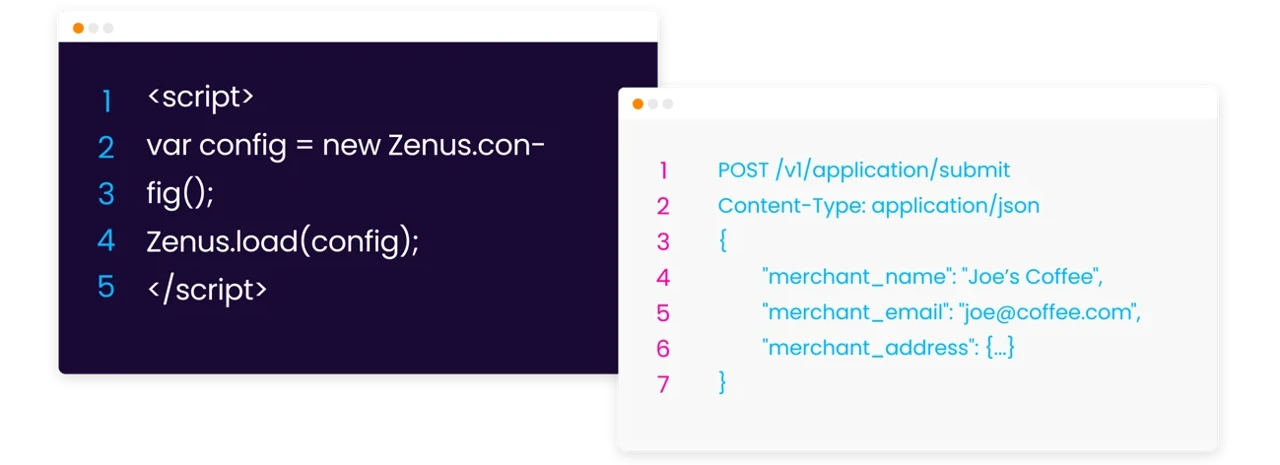

Instant funds with our APIs

Experience the future of payments processing with Fast Funds APIs – where speed, security, and convenience come together for you to build solutions seamlessly. Fast Funds APIs enable you to eliminate inefficiencies and manual errors by streamlining processes, as well as improve security measures, dispelling concerns about data breaches and fraud. Seamlessly integrate Fast Funds APIs with your existing systems, breaking down silos and enhancing operations.

Excellence in payments

We are proud to collaborate with industry leaders to deliver exceptional service. These partnerships highlight our dedication to ensuring secure, efficient, and reliable financial transactions that adhere to the highest industry standards. Together, we aim to set new benchmarks for excellence in the financial services industry.

USE CASES

Fast Funds

- Boost employee retention with fast, flexible earnings.

- Improve your finances’ flexibility with better control over them.

- Elevate client experience with instant consumer payouts.

- Smooth financial interactions with real-time P2P transfers.

- Connect families globally through swift cross-border remittances.

- Easily transfer funds between accounts using debit cards.

Empower financial institutions

Are traditional payment schemes holding your organization back? Fast Funds revolutionizes financial institutions’ payment capabilities by enabling instant local and global payments. Implement Fast Funds today to facilitate seamless transactions worldwide, enhancing customer satisfaction and expanding market reach.

Boost SME growth

Tired of inconsistent pay timing and manual processes? Fast Funds enhances SME operations by automating and accelerating tax payments, payroll, and B2B transactions. This delivers vastly improved efficiency, optimized cash flow, and a competitive edge over rivals.

Modernize government payments

Is outdated payment technology affecting your citizen experience? Fast Funds brings a modern touch to government payments, ensuring not only cost reduction but also the integration of digital efficiencies. This means streamlining processes, reducing manual efforts, and creating a more responsive system that enhances the overall citizen experience.

Set up insurers for success

Challenged by slow and manual processes in claim disbursements? Fast Funds removes traditional hurdles by eliminating manual and costly processes and enabling real-time B2B and B2C payments. This ensures quick claim settlement and disbursement and higher levels of customer satisfaction.

Frequently asked questions

Zenus Fast Funds is an innovative payment processing solution designed to provide businesses with rapid and secure access to global financial transactions. By harnessing state-of-the-art payment infrastructure and technologies, Fast Funds allows businesses to conduct instant and highly secure transactions, regardless of geographical boundaries.

A payment processor is a financial entity that facilitates electronic transactions between businesses, customers, and financial institutions.

Visa Direct is a cutting-edge payment service offered by Visa that enables the quick, secure, and global transfer of funds. It functions as a fast and convenient way to send money directly to a recipient’s card (both Visa and Mastercard are eligible endpoints), even if they are in a different part of the world.

Zenus Fast Funds leverages the power of Visa Direct to provide businesses with a seamless and efficient payment processing solution. When you use Fast Funds, Visa Direct acts as the backbone, facilitating the transfer of funds in a matter of seconds. Here’s how it works:

- Initiation: The payment process begins when a business or individual initiates a transaction.

- Authentication: The Fast Funds platform communicates this to the Visa Direct network, which verifies the transaction’s details and the availability of funds.

- Authorization: Once Visa Direct confirms that the transaction is legitimate and there are sufficient funds, it provides the authorization to proceed.

- Transfer: Visa Direct then securely transfers the funds to the recipient's Visa card, regardless of their location, ensuring near-instant access to the money.

In essence, Fast Funds greatly simplifies the integration and utilization of Visa Direct for businesses, allowing them to take advantage of Visa’s global payment infrastructure to send and receive payments securely and quickly. This collaboration between Fast Funds and Visa Direct empowers businesses to offer efficient local and cross-border payment solutions to their customers. This helps organizations stay at the forefront of modern payment processing and provides convenient payments services to consumers.

Recipients can access funds sent via Fast Funds with remarkable speed. The processing times for our solution are designed to provide near-instant access to transferred funds. In most cases, recipients can expect to access the funds within seconds to minutes after the transaction is initiated. This swift processing time ensures that payments are not just secure but also incredibly convenient, making Fast Funds an ideal choice for businesses and individuals who require rapid access to their funds. Please note that specific processing times may vary depending on various factors, including the recipient’s financial institution and local banking processes, but Fast Funds is optimized to expedite the transfer process as efficiently as possible.

Fast Funds is a versatile solution that can benefit a wide range of businesses and industries. It is particularly advantageous for businesses that require rapid and secure payment processing. This includes, but is not limited to:

- E-commerce platforms: Online retailers and marketplaces can benefit from Fast Funds to offer seamless and secure payment options to customers.

- Financial institutions: Banks, credit unions, and other financial institutions can use Fast Funds to provide real-time payment services to their customers.

- Insurers: Insurance companies can streamline claims processing and disburse settlements more efficiently using Fast Funds, providing policyholders with rapid access to funds.

- Fintech startups: Fast Funds can be a valuable component for emerging financial technology companies looking to offer innovative payment solutions.

- Service providers: Businesses offering services such as gig economy platforms, freelancers, and consultants can use Fast Funds for quick and reliable payments.

- Cross-border businesses: Companies engaged in international trade can benefit from Fast Funds to streamline cross-border payments.

- Mobile payment apps: Apps offering mobile payments, peer-to-peer transfers, and digital wallets can enhance their services with Fast Funds for real-time transaction capabilities.

- Subscription services: Businesses with subscription models can enhance customer satisfaction by using Fast Funds for recurring, instant payments.

Healthcare providers: Healthcare organizations can improve the efficiency of billing and payments with Fast Funds. These are just a few examples, and the adaptability of Fast Funds means it can be tailored to meet the unique payment processing needs of various businesses across different sectors. Whether you're in finance, retail, e-commerce, or any other industry, Fast Funds can help streamline your payment processes and enhance the overall customer experience.

Payments processed through Fast Funds are highly secure. Our platform employs robust security measures to safeguard your financial transactions. These measures include state-of-the-art encryption technologies, multi-factor authentication, and continuous monitoring for suspicious activities. Your data and funds are protected with the utmost care, ensuring that your payments are conducted in a secure and trustworthy environment. Additionally, our compliance with industry standards and regulations further enhances the security of your transactions.

Yes, Fast Funds is available for international payments, making it possible to send and receive funds across borders. Fast Funds provides access to numerous countries and regions worldwide, including the United States, Canada, the European Union, Australia, and many others. The specific list of supported countries may evolve over time, so it’s advisable to check with us or your payment service provider for the most up-to-date information on international availability.