Regulated institutions

Compliance meets innovation

For institutions under regulatory oversight, Zenus's embedded banking solutions ensure compliance while offering innovative financial services. Leverage our secure infrastructure to provide cutting-edge products while maintaining full regulatory compliance and enhancing your customer experience.

Non Regulated Fintech

Innovate with confidence

Fintechs not bound by traditional banking regulations can expand their product offering by integrating financial services into their platform with Zenus. Our embedded banking solutions provide the tools to innovate freely while leveraging trusted partnerships to ensure compliance.

Use Cases

Embedded banking services

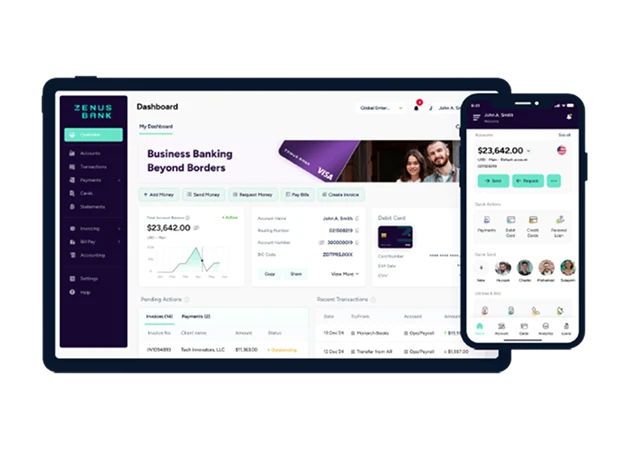

Service beyond traditional banking

Effortlessly launch your own branded mobile apps or online banking platforms without extensive integrations. Offer your customers cutting-edge banking features under your brand, enhancing engagement and loyalty

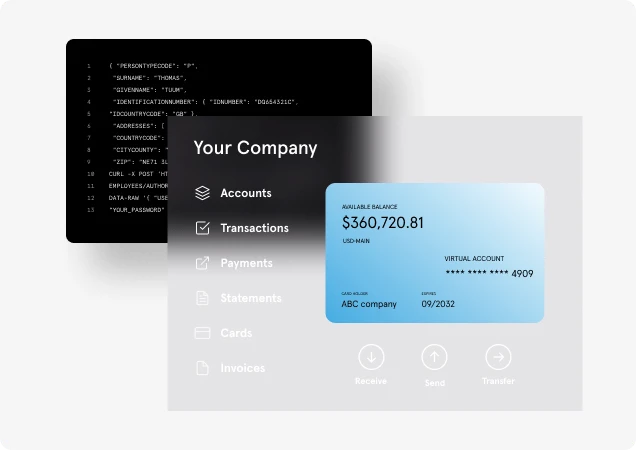

Streamline financial operations

Integrate Zenus Bank’s robust banking capabilities directly into your environment. Our APIs adhere to stringent industry security and reliability standards, ensuring a trustworthy and efficient integration process.

Why choose Zenus embedded banking?

Unlock a secure and scalable banking infrastructure that empowers your business to offer enhanced financial services. Our solutions are designed to support your growth, compliance, and innovation objectives, providing a competitive edge in today's dynamic financial landscape.

Explore how Zenus Bank's Embedded Banking solutions can transform your platform, delivering unparalleled value and convenience to your users.