Integrated with best in class partners to make your journey seamless

Financial Institutions

Global banking solutions

Unlock the power of fast, seamless and secure payments for your clients with our virtual account and embedded banking solutions akin to European IBAN's.

Corporate Entities

Global treasury

Simplify and consolidate your business operations with our international banking services. Tailored to be purely your payments engine, our full-reserve banking model is designed to facilitate and compliment the cross-border money transfer needs for all your group entities.

API IntegratioN

Developer Portal

Integrate banking functionalities into your systems with our robust APIs. Built for developers and operated by an experienced product and innovation team ready to guide your integration journey. Create accounts, manage funds, accept and send payments using our robust API flows enabling you to automate financial operations, enhance user experiences, and offer innovative financial services, all while maintaining the highest standards of security and compliance.

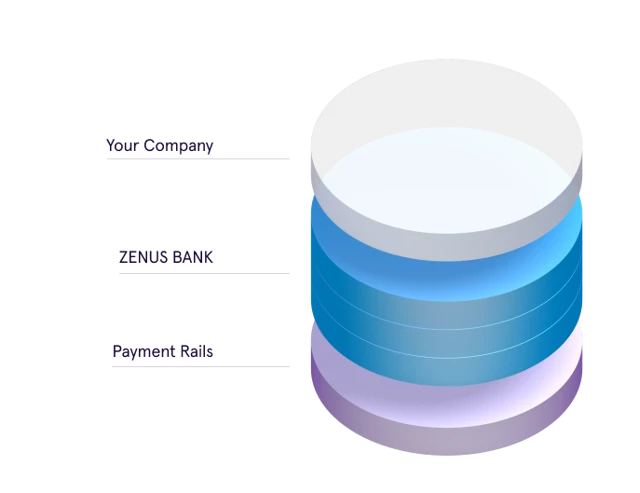

Payment Rails

Seamless payments

Expand your reach around the globe with access to USD and payments in multiple currencies in over 160 countries. Manage accounts, payees, and end-to-end payment flows with a range of banking solutions.

Global Card Issuance

BIN Sponsorship

Our unique BIN sponsorship program enables the international issuance of American virtual and physical USD cards through a single, processor-agnostic sponsor bank. Partner with Zenus and unlock a world of opportunities.

Let's start building

Empower your institution with Zenus Bank's seamless integration. Manage US accounts effortlessly for clients worldwide.